Table of Contents

Since 2013, the US Treasury has required the use of direct deposit for many government payments, such as veterans benefits, Social Security benefits, Supplemental Security Income (SSI), Railroad Retirement Board, Department of Labor (Black Lung), and Office of Personnel Management benefit checks.

This change was made to protect recipients from fraud and to make the deposit payments faster, safer, and more secure.

Note: If you receive multiple VA benefit payments monthly, then you must set up a single account to receive all the benefits. If you currently receive payments into separate accounts, the VA is requiring you consolidate those to a single account before April 20, 2024.

This article explains the change and how you can set up direct deposit for your bank account.

Why Does the U.S. Treasury Require Electronic Federal Benefit Payments?

Why did the government switch to electronic payments? There are four reasons:

Financial Crime.

Stolen checks or fraudulent claims have always been a problem for the government’s massive programs. There are millions of people receiving government benefits checks each month. This can equate to millions of dollars in lost funds, even if just a small percentage of transactions are fraudulent or result in financial crime.

Immediate Access.

Offering recipients direct deposit or a prepaid debit card means recipients will have immediate access to their funds. They won’t have to wait for the mail service to bring an envelope, then take a separate trip to a bank to cash or deposit the check. The money will be available on time, every month.

Easier Problem Resolution.

If a problem occurs with a check it is a lot harder to track down where the problem occurred with a paper check. Was it lost in the mail or is it just late in being delivered? With electronic payment, it will be a lot easier to track down any problems that do occur.

Cost Savings.

When the government sends out millions upon millions of benefit payment checks each year they have to print the check on paper, put it in a paper envelope, and pay postage on it. All of those things are cost overheads for running the program. With electronic payment, you still have some overhead, but you’re not wasting money on ink, paper, and delivery.

What are the Electronic Payment Options?

You have two options to select from:

- Direct Deposit. You can have funds directly deposited into your bank account just like you would with a paycheck if you were employed.

- Direct Express® Prepaid Debit Card. If you don’t have a bank account, the government will send you a prepaid debit card that will have your funds placed on it each month.

WHIle some people choose to receive payments on a prepaid debit card, having your payments directed to a bank is safer and more secure than having your benefits deposited into a debit card.

What if I Don’t Have a Bank Account?

You can always opt for a prepaid debit card. However, using a bank is safer and more secure. You have no recourse if your prepaid debit card is lost, stolen, or hacked. You have much more transparency and security with a bank account.

We recommend opening a bank account with a military-friendly bank. There are many military-friendly banks that offer free checking and savings accounts, including USAA, Navy Federal Credit Uniton, and Chase Bank. Chase Bank even offers a lucrative sign up bonus for opening a new bank account.

If none of those recommendations work for you, then check out the V terans Benefits Banking Program (VBBP), a collaboration with the Association of Military Banks of America (AMBA) and the VA.

How Will I Know My Money Has Been Deposited?

A common question you might have is how will you know that your Federal benefits money has been deposited. That depends on which method you select to get your deposit.

With direct deposit you can:

- Call your bank to verify the deposit has gone through

- Check your bank’s online website to see if the deposit has gone through

- Go to your bank in person to speak with someone that can look up your account information for you

With the prepaid debit card option you can:

- Receive free text messages to alert you that the deposit has posted to your debit card

- Receive an email alerting you that the deposit has posted to the debit card

- Call an automated message that will confirm whether or not your deposit has posted

How Does Direct Deposit Work?

Direct deposit is like having the government send a check directly to your bank on your behalf. It saves you from having to wait on it to be delivered and then driving to your bank to deposit the check.

Instead of mailing your Social Security Retirement check, the deposit amount is transferred electronically to your bank and directly into your bank account. Many employed individuals receive their paychecks each month via direct deposit, and the concept is exactly the same here. Your personal information is never transmitted or at risk; your bank gets a notification to deposit X funds in Y account number and then does so.

Are Electronic Payments Safe?

Electronic payments are actually more safe and secure than paper checks. Paper checks can be stolen, lost, delivered to the wrong address, and copied. With an electronic payment the funds are immediately available in your bank account (if you selected direct deposit) or on your prepaid debit card on the payment day each month. You don’t have to worry about something happening to the check in-between the government mailing it out and when you deposit or cash it at your bank.

How Do I Make My Electronic Payment Selection?

Making your selection is easy. You can:

- Visit GoDirect.org (a government website), specifically the switching to the electronic payment page

- Call GoDirect at 1-800-333-1795

You will need to have some information handy based on which selection you are making.

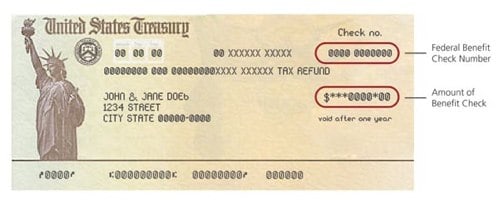

If you are choosing direct deposit, you need a few things. You may find it helpful to grab a copy of your most recent check from the US Treasury. It should look like this:

You will also need:

- Social Security number or claim number

- 12-digit federal benefit check number

- Amount of most recent federal benefit check

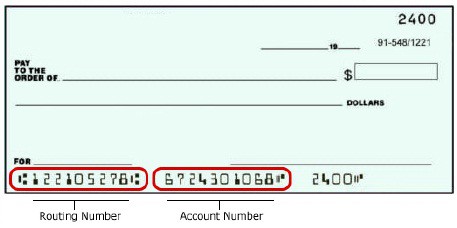

- Financial institution’s routing transit number (can be found on your check or by calling your bank)

- Account number and type – checking or savings. The following image shows where you can get the information from your bank account:

If you are choosing the Direct Express® Prepaid Debit Card, you need:

- 12-digit federal benefit check number

- Amount of most recent federal benefit check

Note about TSP withdrawals: This only applies to payments from the U.S. Treasury. This does not apply to TSP participants at this time. You will continue to receive TSP payments as you are currently receiving them.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

S L Davidson says

My mother’s direct deposit for VA check has been changed without her consent. She is no longer receiving her check and it is now going to someone at an address different from hers. The VA says it is not theft if someone has changed her direct deposit, but of course, it is.

What should she do?

Ryan Guina says

S L, I recommend that your mother file a formal report with the VA and/or the police indicating there has been a theft. She should also document every step she has taken in the process so she has proof that she has contacted the VA in a timely manner. Best wishes!

Richard Presswood says

Changed routing and account number want to make sure VA has this information

Raymond Dongkrathok says

I have direct deposit, but it keeps coming in my previous name, which I changed 20 years ago, it was my veteran name. I have changed my name in VA, also in DEERS, but my disability direct deposit that comes out of VBA in Hines Illinois, always comes to my bank account with my old name. Hundreds of phone calls, no one can tell me what to do, I need to change the last name so it credits to my account.

constantlyn S james says

I have a chime card does that mean I can’t use unless I have a bank account

David Williams says

How do I get my account number and routing number