When you sign up for the Thrift Savings Plan (TSP) you are given a choice between six fund options, all based on index funds. Index funds allow investors to buy a bundle of stocks that track a single market sector.

Lifecycle Funds, also called L Funds, are structured differently. This group of 11 fund options uniquely mixes portions of the other five funds based on a retirement plan end date.

L Funds became the default option for TSP participants in 2015 and, as of 2022, is the most popular option for younger federal employees, with about two-thirds of all TSP participants enrolled in this family of funds. Participants are loosely matched with the anticipated date of their retirement.

In other words, if you think you might retire in 2038, you might be placed in the 2040 L Fund, although you can decide which one to enroll in.

For example, while the TSP G Fund tracks short-term US Treasuries exclusively, L Funds diversify participant accounts among the G, F, C, S, and I Funds, using professionally determined investment mixes tailored to different time horizons.

Many people perform their own asset allocation and choose which investments to invest in. Asset allocation simply means that different percentages of the other five funds are combined to create L Funds with varying risk levels.

Funds with a target date further into the future are weighted with more risk than funds with a shorter maturity date.

Lifecycle Funds take an alternative approach with allocation based on investment modeling by a well-respected consulting group. Rather than a participant making decisions, investing in an L Fund means transferring that critical analysis to industry professionals.

L Funds automatically adjusts over time to lower the portfolio risk as you get closer to the target date. Because this allocation is strategically determined by experts, it’s best if you put money into an L Fund and don’t also invest in other TSP funds. Doing so will screw up your properly balanced asset allocation.

As a result, you will create too much risk based on the return you want to make, or you won’t be making as much money as you should expect from the risk you’re taking. You can adjust your allocations manually to ensure your portfolio is properly balanced instead of leaving that to a professional who will automatically do that on your behalf.

When you have money in other accounts that aren’t in your TSP, you also run the risk of unbalancing your risk as well. This could alter your long-term financial planning goals and indirectly impact your L Fund or TSP allocation efforts.

In such cases, meeting with a financial planner is often best to discuss your options and allocation investment goals.

Investment Objectives of TSP Funds

To fully understand how L Funds work, first, it’s best to start with a brief overview of the other TSP funds. Those fund choices include:

G Fund – Short-term U.S. Treasuries specially issued to the TSP. The U.S. Government guarantees payment of principal and interest.

Thus, there is no credit risk. The G Fund offers the opportunity to earn interest rates similar to those of long-term Government securities but without any risk of loss of principal and very little volatility of earnings.

F Fund – U.S. Corporate Bonds that seek to match the performance of the Lehman Brothers U.S. Aggregate (LBA) Index, a broad index representing the U.S. bond market.

C Fund – Large U.S. Companies (S&P 500) that seek to match the performance of the Standard and Poor’s 500 (S&P 500) Index, a broad market index comprised of stocks of 500 large to medium-sized U.S. companies.

S Fund – Small U.S. Companies (Wilshire 4500 Index) that seeks to match the performance of the Dow Jones Wilshire 4500 Completion (DJW 4500) Index, a broad market index comprised of stocks of U.S. companies not included in the S&P 500 Index.

I Fund – International Fund that seeks to match the performance of the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index.

You can also visit the TSP home page and click on Fund Options for more detailed fund objectives and information.

How the L Funds Work

There are eleven L Funds to choose from based on their target maturity dates. Ten of those funds have target dates in five-year timeframes ranging from 2025 to 2070. The exception is the L Income Fund, explained in greater detail below.

The asset allocation of these funds differs based on risk. For example, the L Fund maturing in 2030 is more conservatively weighted than the L Fund maturing in 2060.

The thinking is that as the end date for a fund grows closer, the emphasis changes from maximum growth and returns to protecting and preserving gains.

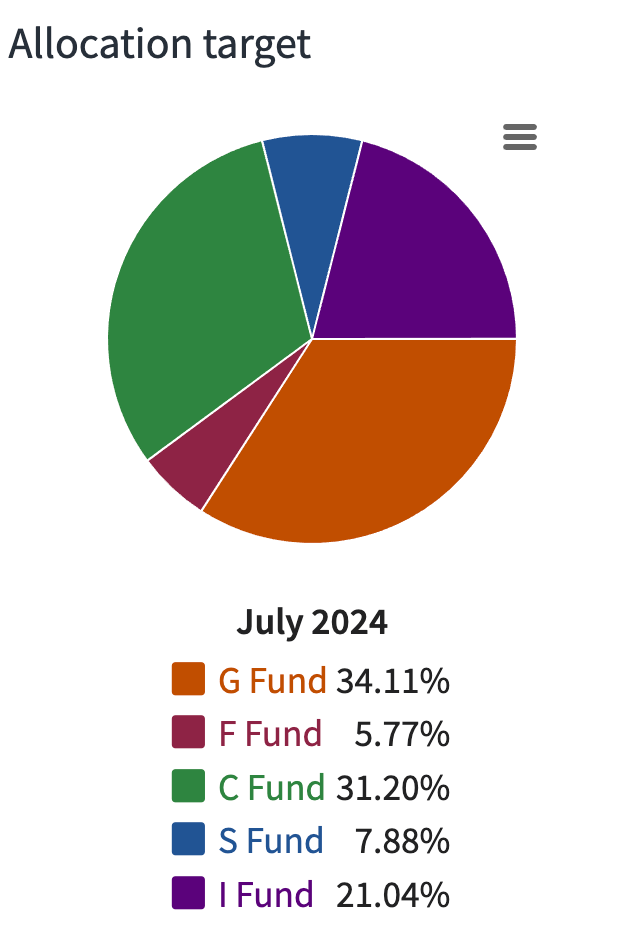

So, an L Fund with a 2030 target date will have a higher percentage mix of a G and C Funds which offers lower but more conservative returns through stable US Treasuries and large US companies. The allocation mix for the 2030 L Fund at the end of 2023 looked like this.

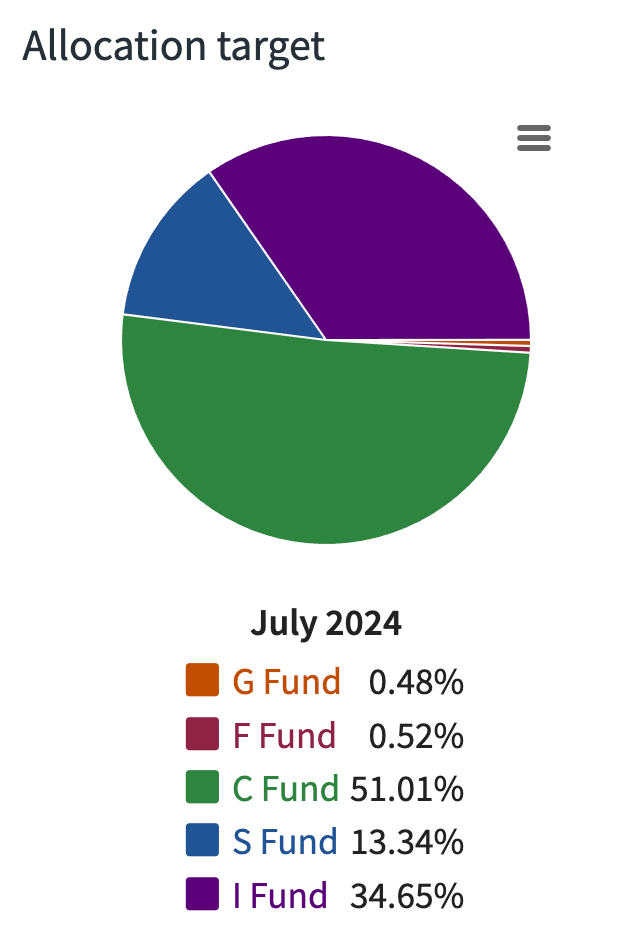

This is contrasted by an L Fund with a 2060 date which will have a greater weighting of C and I Funds, representing a higher risk but with a higher anticipated return to grow a participants TSP account.

They were designed to let you invest your entire portfolio in a single L Fund and get the best expected return for the amount of expected risk that is appropriate for you.

Every three months, the target allocations of all the L Funds (except the L Income Fund) are automatically adjusted, gradually shifting them from higher risk and reward to lower risk and reward as they get closer to their target dates.

These allocations do not change even if individual funds don’t perform as well as others. However, each day, to maintain the L Fund’s target allocation, administrators rebalance the L Funds by buying and selling individual funds so that percentages go back to what they were at the beginning of the day.

This active approach means that fund managers are buying low and selling high at the end of every trading day to maximize returns.

The L Income Fund

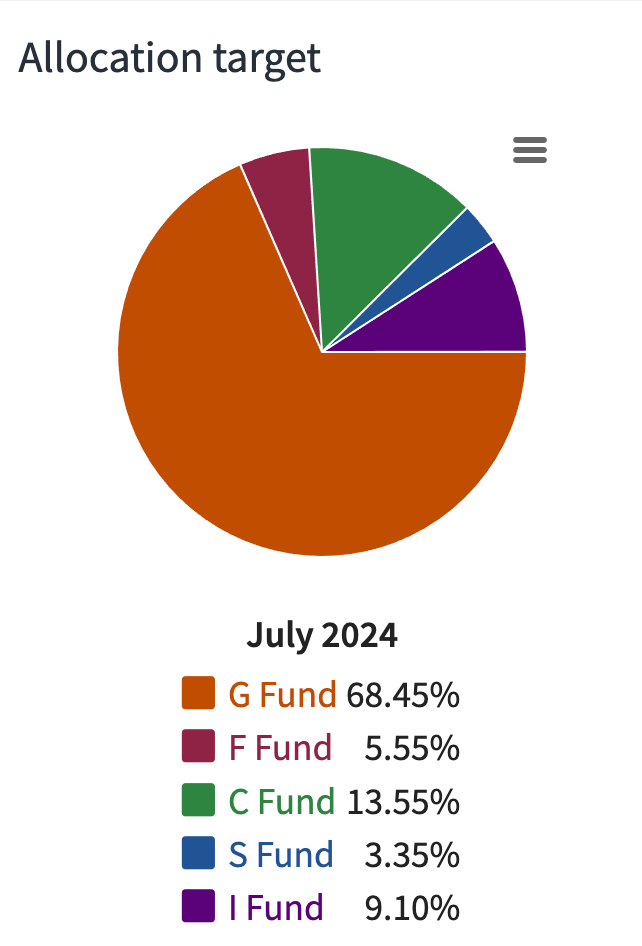

The L Income Fund is best suited for participants born before 1960 who are currently making withdrawals from their TSP account as part of their retirement income. For this reason, the L Income Fund is the most conservative of all L Funds.

It focuses heavily on money preservation and minimal risk, although it is still subject to losses and gains.

This is why it is weighted more heavily on G and F Funds and less on the more risky C, S, and I Funds. This strategy also focuses on reducing inflation’s effect on a participant’s purchasing power.

When an L Fund reaches its target date, it goes out of existence and any money in it becomes part of the L Income Fund. For example, when the 2025 L Fund matures and hits it’s target date it will be folded into the L Income Fund.

Should I Invest in a Lifestyle Fund?

It depends. L Funds are best for people who are new to investing or not confident in their investing knowledge and want assistance in a well-thought-out long-term investment strategy.

While it is less tailored than a fully individualized investment approach, if you agree with the level of risk and financial goals of a target date strategy, this is a hassle-free and relatively conservative strategy that can work well for you.

Learn More About the TSP and Lifestyle Funds

This article is a good introduction to L Funds, but as it is with any investment, you should do as much homework as possible until you become comfortable making a choice that best fits your situation.

Here are some other resources we’ve created to help you better understand your investing options.

Why the TSP Has Enough Diversification for Any Investor

The Thrift Savings Plan Mutual Fund Window

Thrift Savings Plan Contribution Limits

How to Manage Your Thrift Savings Plan Account

Thrift Savings Plan Annuity Calculator

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.