Everyone knows that tax-advantaged accounts can provide benefits that you don’t get from taxable accounts. In the military, the Thrift Savings Plan is a great first step towards saving for retirement. Within the Thrift Savings Plan, you can even choose specific asset allocations designed for when you need to start using the money by using their Lifecycle Funds. However, you might be curious about IRAs, and whether you should choose a traditional IRA or a Roth IRA. Below are 6 reasons you would want to choose a Roth IRA over a traditional IRA.

Reason #1: You Don’t Need a Deduction Now.

You may choose to invest in a Roth IRA if you don’t need the tax savings right now, and plan to be in a higher tax bracket when you start withdrawing from your IRA.

When you compare a traditional and a Roth IRA, the biggest difference is when you realize tax savings. Since a traditional IRA allows you to take an immediate tax break on your contribution, it makes sense for people who are in high income brackets (over 25%).

Reason #2: You Plan to be in a Similar or Lower Tax Bracket

Most servicemembers and families are in lower tax brackets, especially those with members who routinely deploy to combat zones. When these members retire, they might realize a slight increase in their tax liability due to the loss of their allowances. However, that increase usually will keep them in the same tax bracket.

If you expect to use your post-military career ramp up your net worth, you should pay the taxes now. That way, you can enjoy tax-free growth in your retirement years. This decision requires a lot of thought about how you envision the rest of your life.

Reason #3: You plan to have more assets than you can use in your lifetime.

If you’re tracking with reasons #1 & #2, then you might end up in a position where you achieve financial independence fairly early. In that case, it’s worth considering what you’ll do with the money you’ve accumulated. Here’s another key difference between traditional & Roth IRAs.

With a traditional IRA, you’ll have to start taking required minimum distributions (RMDs) after you’ve reached 70 ½. If you already have enough income to support your lifestyle, then your worry becomes more about how to minimize your tax liability. While there are several things you can do to minimize your tax liability with RMDs, it’s much easier to avoid them.

When you choose a Roth IRA, you don’t have to take RMDs. Ever. The money is there when you need it. However, you can let it grow tax free for the rest of your life without being forced to withdraw it.

Reason #4: You plan to work past age 70 ½.

With a traditional IRA, the IRS does not allow contributions past age 70 ½, even if you’re working. When you choose a Roth IRA, the IRS will allow you to contribute for as long as you have earned income.

Reason #5: You’re covered by a workplace retirement plan, and your income is above the deduction limit for a traditional IRA.

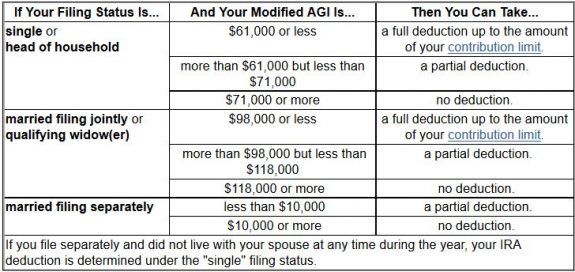

This probably will not happen while you’re on active duty, but it could happen during your post-military career. There are no income limits for traditional IRA contributions. However, the IRS limits the deductibility of those contributions if either you or your spouse is covered by a workplace retirement plan.

The impact is that if you are covered by a workplace retirement plan, and your income is above a certain threshold, your deduction might only be partially deductible or not deductible at all.

If you leave the military, you should be aware of:

- The availability of a qualified workplace retirement plan

- Your expected adjusted gross income (AGI)

Knowing these two things will help you decide whether it’s appropriate to choose a Roth IRA over a traditional account.

Reason #6: You plan to generate cash flow from your IRA to support your living expenses

A lot of people use the following savings plan:

- Save as much money as possible during working years

- Figure out what to do with that money after retirement

In general, people are really good at Part 1. However, they don’t think about what to do with Part 2 until retirement. As a result, a retired couple has usually built a nice-sized nest egg. When they do, they turn this money over to a money manager. Most likely, the money manager will use this to generate an income stream, based upon the retired couple’s needs.

However, with a little forethought, this couple could have constructed the same portfolio in a Roth IRA. The Roth IRA would then generate this income on a tax-free basis. If you plan to use your IRA to generate income, you should consider your tax liability during your retirement years.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.