Understanding your taxes is a big part of financial planning, whether you’ve already retired or are in the midst of your career. Very few factors can impact how your income is taxed more than where you live, and with the frequency that legislation at the state and local levels changes, it’s important to stay up-to-date on current tax policies affecting military retirement pay.

Currently, two states that tax military retirement pay are considering adjusting their policies:

1. Delaware: A bipartisan bill would eliminate the age requirement for its military retirement pay tax exemption. It would also gradually increase the exemption amount from $12,500 to $25,000 in three years for all retired military personnel.

2. California: A bipartisan bill would eliminate state income taxes on military retirement pay and spouses covered in the Surviving Benefit Plan (SBP).

Other states considering amended tax policies toward military retirement pay include: Oregon, New Mexico, and Maryland.

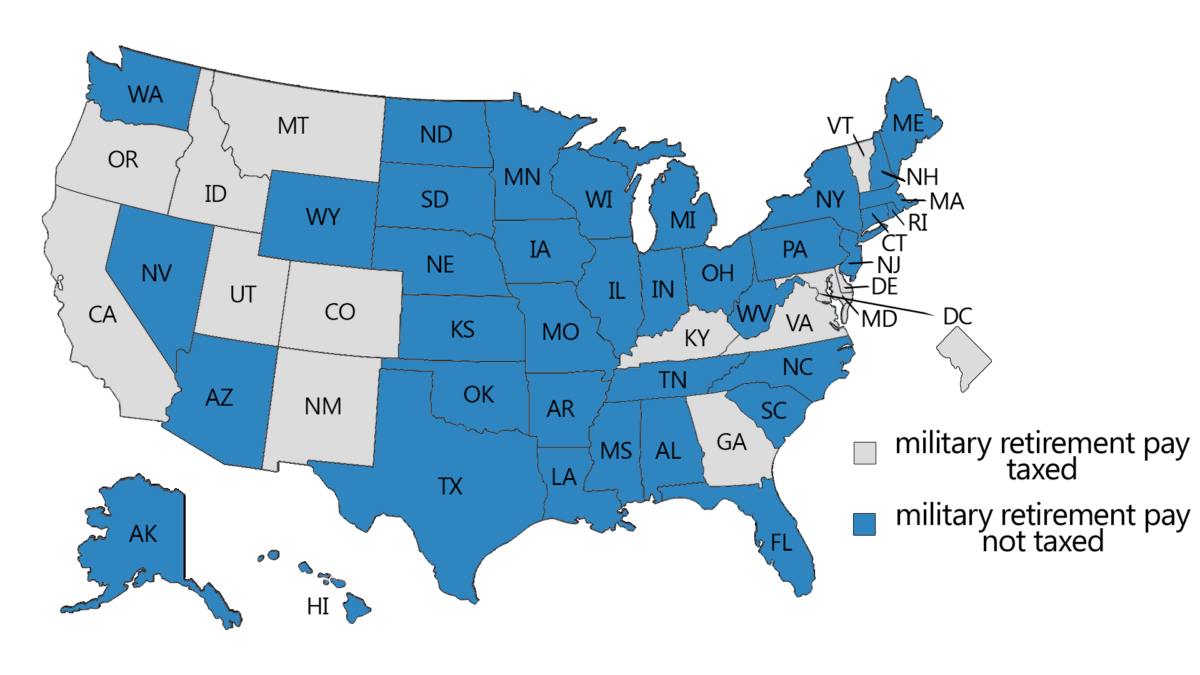

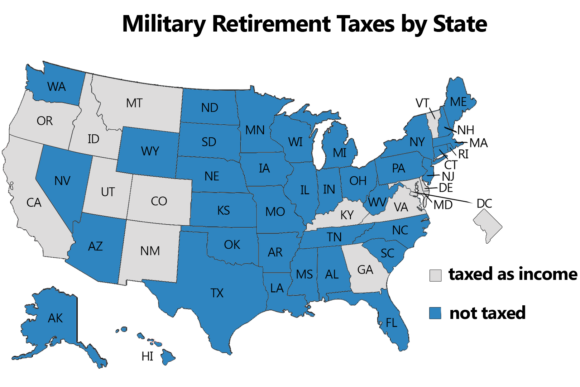

States That Don’t Tax Military Retirement Pay

Currently, 37 states don’t tax military retirement pay at all. Those states either have specific policies excluding military retirement pay from income tax or are states that don’t tax any type of income.

| States That Don’t Collect Any Income Tax | States That Exclude Military Retirement Pay From Income Tax |

|---|---|

| Alaska, Florida, Nevada, New Hampshire*, South Dakota, Tennessee, Texas, Washington, and Wyoming | Alabama, Arizona, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, West Virginia, Wisconsin |

Figuring your military retirement pay into taxes is more unique than civilian retirement pay in two aspects. First, it can affect someone older, whose monthly budget may be fixed based on the pension. A civilian retirement is taxable income in the states where it is collected. But your monthly budget is larger if you’re retired military, and the state you live in offers an exemption for military retirement pay.

Secondly, taxes on military retirement can affect someone younger pivoting to a civilian career but still eligible for a retirement pension. If a state offers an exemption for military retirement pay, their monthly budget will be larger than those with retirement tax policies. The added ripple comes in states with partial exemptions on military retirement pay. They tend to have age-related policies, so if you serve two decades of active-duty service and retire in your 40s, you may be limited on how much annual retirement pay can be deducted from state income taxes.

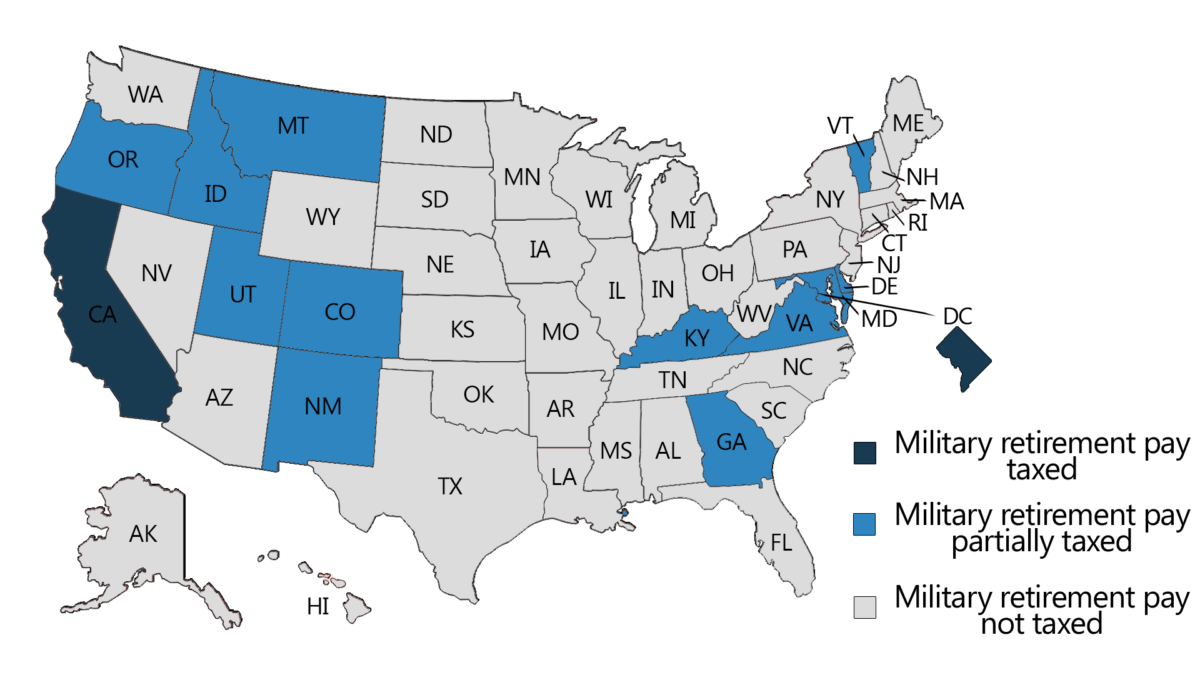

States That Tax Military Retirement Pay as Income

Twelve states partially tax military retirement pay or provide limited exclusions based on individual circumstances. California is the only state that fully taxes military retirement pay as income. However, Washington, D.C. also fully taxes military retirement pay as income.

As recently as the 2022 tax year, Indiana, Nebraska, and North Carolina passed laws ending income tax on military retirement pay.

Military Retirement Income Taxes By State

States with a partial exemption on military retirement pay have varying tax policies, which are laid out below.

| State | Military Retirement Pay Income Tax Policy |

|---|---|

| Colorado | Under 55 get exempt up to $15,000 through 2028. 55 and older can claim regular pension and annuity subtraction on the applicable line of the Colorado subtractions from the Income Schedule (DR 0104AD). |

| Delaware | Under 60 can exempt $2,000. 60 and older can exempt $12,500. |

| Georgia | Under 62 exemption up to $17,500. If they have earned income over $17,500, they may claim up to an additional $17,500.Veterans ages 62 to 64 are eligible for Georgia’s existing retirement income tax exemption for up to $35,000. Over 65 are eligible for up to $65,000. |

| Idaho | Married filing jointly: May exempt up to $60,210 if age 65 or older or if disabled and age 62 or older.Single: May exempt up to $40,140 if age 65 or older or if disabled and age 62 or older. |

| Kentucky | Regardless of age, allows a pension income exclusion of up to $31,110. You may be able to exclude more than $31,110. |

| Maryland | You or your spouse may be able to subtract up to $12,500 from your military retirement income.If you are 55 and older, you can subtract $20,000 from your military retirement income. |

| Montana | For up to 5 years after becoming a Montana resident, retirees may exempt the lesser of: 50% of retirement pay, as reported by DFAS ORMontana source income (from wages, salary, and tips from compensation; Net income from a trade or business in Montana; Net income from farming activities in Montana) |

| New Mexico | Regardless of age, $30,000 exempt from 2024 through 2026. |

| Oregon | You may subtract your pension from Oregon income tax to the extent it was earned before October 1, 1991. Your entire pension is taxable if all of your service was after October 1, 1991. |

| Utah | Offers credits for military retirement pensions which is the product of the retired Service member’s federally taxable military retired pay multiplied by 0.0485. |

| Vermont | Offers a $10,000 exemption for joint filers with an income of $75,000 or less. Offers a $10,000 exemption for single filers with an income of $60,000 or less. Cannot be combined with exemptions for other pensions (i.e. Social Security, CSRS, etc.) |

| Virginia | Can exempt $30,000 for the 2024 tax year and $40,000 for 2025 and later. |

Income Taxes and Inbound/Outbound Migration

As mentioned earlier, where you live impacts your income taxes. It’s such a big deal, that servicemembers often move from states with higher state income taxes to states with low or no income tax to retire.

“Each state has a variety of additional benefits and privileges for veterans and retirees that should be considered. For example, some states have property tax exemptions, free state park passes, and military discounts,” Stacy Miller, CFP and founder of BayView Financial Planning said. Later, alluding to taxes impacting professional transitions, “As military service members usually retire well before the traditional retirement age, proximity to an encore career, family, and lifestyle choices are all a part of the overall decision.”

When breaking down U.S. Census data, the Tax Foundation, a non-profit organization researching the impact of state, federal, and national taxes, found states with higher taxes saw the most outbound migration, meaning people leaving the state. States with lower income taxes were among the leaders in inbound migration, or people moving to the state.

Note: Of the states in the top 10 of inbound migration, 7 offer tax exemptions for either state income taxes or military retirement pay.

Calculating the Tax Difference in Military Retirement Pay

Financial experts see taxation, particularly on military retirement pay, as a motivating factor for where military families choose to live.

“Fort Moore is technically in both Georgia and Alabama, so service members and veterans can live in either state and still commute to the U.S. Army base easily,” Miller said. “When my husband [who retired after 28 years of service with the U.S. Army] and I were stationed at then Fort Benning [now Fort Moore], the Alabama community and state leaders would often discuss their state income tax exemption at ceremonies and social events as an incentive to retire in Alabama.”

Example Calculation

It’s one thing to talk about tax percentages, it’s another to show you the difference. So let’s imagine you were stationed at Fort Moore and retired as a Sergeant First Class at 39 years old after 21 years in the Army. In this hypothetical situation, say you want to start a business to earn $55,000 annually.

Your monthly retirement pay amounts to $2,808.23, giving you an annual total of $33,700. If you decide to live in a state like Alabama, which does not tax military retirement pay, this income remains untaxed.

However, in this scenario, say you choose to live in Georgia, which offers a $17,500 exemption for military retirees under 62, you’ll have $16,200 of your retirement as taxable income. When adding this to your business earnings, your total taxable income becomes $71,200. At Georgia’s flat tax rate of 5.49%, you would pay $3,908.88 in taxes. In contrast, in Alabama, only your income from the business is taxed at 4.18%, totaling $2,299 in taxes. It comes to a difference of $1,609.88 in taxes!

Military Retirement Pay and VA Disability Compensation

Military retirees pay federal taxes on retirement pay. However, some situations may impact your retirement pay. A common one is receiving VA disability compensation due to a service-connected disability rating.

VA disability compensation is nontaxable, however, retirement pay becomes affected when servicemembers are eligible for both benefits.

Your disability rating determines whether you can receive military retirement pay and VA disability compensation concurrently (without offset). Military retirees with a service-connected disability rating of 50% or higher or a combat-related disability rating of 10% or higher receive concurrent receipt, which has no impact on military retirement pay.

Those with a service-connected disability rating of 40% or less are ineligible for concurrent receipt and have their military pension reduced by the amount of disability compensation they receive from the VA. The amount from the VA is nontaxable. The net effect is to receive the same amount of income. However, the portion from the VA is tax-exempt, which lowers your effective taxable income.

Just remember, taxes are only a small factor in your relocation decision. You should consider all your priorities and make the decision that best suits you.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Sadie says

Thanks so much for this information. Is the information outlined in the article applicable to disability pay as well? Meaning, disability pay for a service related disability would have the same tax treatment applied?

Brittany Crocker says

Hi Sadie, that may depend on the state. Which state are you asking about?

Damion King says

USAR SM here. HOR is IL. Since joining the mililtary back in 2012, IL has never taxed my military income. You may want to update that on this list. I was AD 2012 to 2017, then Reserves 2017 to current. Again, IL has never taken out state income tax from my military pay.

Ryan Guina says

Thank you, Damion. Some states, including IL, do not take military pay. However, this article is focused on military retirement pay. We don’t have an article that covers which states tax military income from those who are still serving. Thanks!