I’ve written several articles about Roth conversions, particularly tax planning considerations & marginal tax rate impacts. This article serves as a case study to help visualize how a Roth conversion strategy could work, and how the tax liability can fluctuate based upon the timing of Roth conversions. There are many variables that affect tax liability for Roth conversions, including:

- Time horizon: The more time you have before required minimum distributions (RMDs) begin, the more years you can spread conversions. This can allow you to maximize conversions during years with low taxable income & lower conversions during years of high taxable income

- Amount to be converted

- Total taxable income: The lower your taxable income, the more you can take advantage of conversions at the lowest tax brackets. Additionally, the lower your income is WITHIN your current bracket, the more you can convert without spilling over into a higher bracket

- Investment returns on the traditional account: The higher your investment returns, the more you will have to convert. For example, if you start with $500,000, you not only have to account for that amount, but for the future gains in that account.

- We’re also disregarding the Medicare Tax on Investment Income, which is 3.8% of income over $250K.

In this article, we’ll use a fictional example of a military family looking to do a Roth conversion from their traditional TSP account to an IRA as they transition to post-military life. However, we won’t focus on the WHY. Instead, we will solely focus on three ways they could do so, and which manner presents the lowest overall tax liability–the HOW.

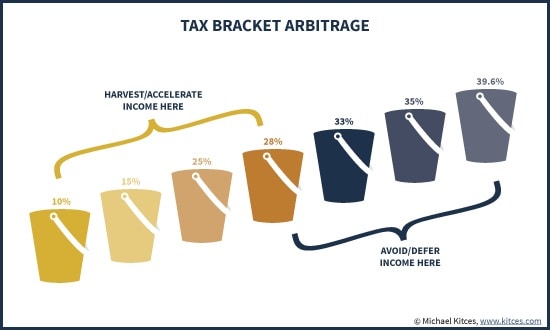

In real life, the comparison of current and anticipated future tax brackets plays a very important role in the Roth conversion decision. As a result, the decision on whether to perform a Roth conversion depends on a variety of factors that we won’t discuss here. However, if you’re looking for a financial planning ‘rule of thumb,’ the below picture represents a close estimate from one of the financial planning profession’s thought leaders, Michael Kitces.

As you can see, there appears to be an inflection point at the 28% tax bracket. In the 10%, 15%, and 25% brackets, it appears that Roth conversions may be warranted. In the 33%, 35%, and 39.6% brackets, it seems that Roth conversions should be avoided. However, without context on what post-retirement tax bracket you’ll be in, it’s hard to make this an absolute rule.

Disclaimer

There are a lot of complexities involved in tax planning. To avoid getting off-topic, I will make a lot of tax planning assumptions in this article. Additionally, I will round numbers (such as salary or pension amounts) where possible. As a result, this situation will seem overly simplistic.

I will do my best to account for these variables, but there may be something that I omit. Accordingly, this article should be read for educational purposes, not instructional purposes.

Tax planning in real life is much messier than in this example, and is not a static process. Proper tax planning should incorporate a tailored approach for each individual situation, and should be reviewed periodically. While it’s possible to do so yourself, you may find the need to work with a tax professional or fee-only financial planner.

Final disclaimer: This article was written to be a work-in-progress. The intended point is to highlight the benefits of converting to a Roth account at the lowest possible tax-rate. However, I’ve enclosed the a copy of the Roth Conversion spreadsheet that I used to come up with the information below. If you have any suggested edits, comments, critiques, or concerns, PLEASE post a comment below. This is not a perfect document, and I expect that it will only improve if you help me identify mistakes so I can correct them. I will do my best to update this article as quickly as possible.

Introduction

Let’s welcome the Smiths. The Smiths are retiring from the military and expect to settle down in their home of record. John is retiring as an O-5, and expects his pension to be around $40,000 per year. They also expect their pension to increase at the same rate of inflation. For planning purposes, they’re using 3.77%, which is the historical average post-WWII inflation rate.

In their home of record (with no state income tax), they expect John’s new salary to start at $50,000 per year, with average salary increases of 2% per year. The Smiths have saved $500,000 in their traditional TSP account, and would like to convert to a Roth before retirement to avoid RMDs. They plan to do their TSP conversions to an IRA. They don’t know if they will be in a higher tax bracket in retirement, but they would rather pay their taxes now so they can live worry-free later on. The Smiths just turned 45, so they have about 25 years before RMDs become a concern, and are trying to figure out how to convert their account in a way that gives them the largest after-tax Roth balance at age 70.

We will compare several scenarios, which dictate the top marginal tax rate at which the Smiths are willing to do a Roth conversion:

Scenario 1: Immediate conversion. This means that the Smiths will immediately convert to a Roth IRA. Due to their income & conversion amount, this will push them into the top tax bracket, 39.6%. In addition, they’ll incur the Medicare tax on investment income over $250,000, which is not calculated here.

Scenario 2: 25% rate. This means that the Smiths will convert as much as possible up to the 25% rate each year. Since they do not want to pay more, they will wait until the following year to convert additional amounts. In 2017, this amount is $153,100 for a married couple filing jointly.

Scenario 3: 28% rate. Same as Scenario 2, except the Smiths will convert at the 28% rate as well. In 2017, this amount is $233,350 for a married couple filing jointly.

Scenario 4: 33% rate. Same as Scenario 3, except the Smiths will convert at the 33% rate as well. In 2017, this amount is $416,700 for a married couple filing jointly.

Scenario 5: 35% rate. Same as Scenario 4, except the Smiths will convert at the 35% rate as well.

Assumptions

Here’s where we’re going to make some assumptions strictly for the purposes of simplifying this scenario. Doing so is the only way that I can provide supporting documentation (in the form of an enclosed spreadsheet that anyone can use for their purposes).

While some of these assumptions may be true, it’s highly unrealistic to expect most (or any) of these factors to remain the same over a 25-year period. It’s also unrealistic to attempt to make some projections (future IRS tax brackets, for example), so I’ve kept them constant for this article.

In a true planning situation, these factors would be re-evaluated on a regular basis to account for changes:

- Income growth. We’re assuming zero change in employment status, other than consistent annual raises. Also, we assume zero additional income from other sources, like after-tax investments or capital gains (like from an accidental rental). We’re also assuming a flat, 2% raise in salary.

- Inflation (COLA raises) remain the same over time. For this scenario, I used 3.77% for annual pension increases. Although this is the post WWII average inflation rate, this rate has fluctuated, and would change annually.

- A consistent annualized return on investment. This return is after account management fees. Investment results depend on a variety of factors, and it is not possible to predict future rates of return. For projection purposes, financial planners often use an annual rate of return, based upon expected long-term results that are consistent with the investment selection. In this case study, we’re using 7% as an average long-term return. This is probably lower than most projected returns.

- Tax brackets remain the same over time. The IRS typically updates tax brackets annually to account for inflation. In this case, I’ve kept them the same.

Additionally, it is possible for many servicemembers to use the 10% & 15% tax brackets for tax planning purposes. In fact, if you’re still on active duty, you should look at taking advantage of these lower tax brackets for Roth conversions.

However, this working document does not include these tax brackets because in most cases, transitioning military personnel (especially those with pensions), will find their taxable income above the 15% bracket. In this situation, the Smiths’ starting income precludes them from converting at the 10% or 15% rate. The tax brackets that we will use (for a married couple filing a joint 2017 return) are as follows:

| 25% | $ 75,901.00 | $ 153,100.00 |

| 28% | $ 153,101.00 | $ 233,350.00 |

| 33% | $ 233,351.00 | $ 416,700.00 |

| 35% | $ 416,701.00 | $ 470,700.00 |

Scenario 1: Immediate Roth conversion of the entire TSP account.

In this scenario, the Smiths convert 100% of the TSP account to a Roth IRA, without regard to tax liability. This approach will allow them to avoid RMDs, and will allow them to enjoy their retirement account growth on a tax-free basis. Additionally, they can withdraw their conversion amounts at any time without penalty, as long as the account has been open for 5 years. If they’re opening a new Roth account for a rollover & conversion, they would have to wait 5 years to start withdrawals.

In doing this, the Smiths would pay $167,533.30 in taxes to convert the entire $500K amount. This represents an effective tax rate of 33.51% on the conversion. If this money were to be left alone and grow at the stated rate (7% annually), it would reach a total of $1,686,393 by age 70. This money would be tax-free and free of RMDs, so it could continue to grow tax-free infinitely.

Scenario 2: Roth conversion at no higher than the 25% rate.

Under this scenario, the Smiths will convert a portion of their Roth account every year, but only to the point at which they fill out the 25% tax bracket. Since their combined income exceeds the 15% tax bracket ($75,900 in 2017), we can assume that all of their conversions will occur in the 25% tax bracket. For a married couple filing jointly in 2017, the 25% tax bracket ranges from $75,901 to $153,100. In year 1, their combined $90,000 in income would leave them with $63,100 to convert before they ‘bump up’ to the 28% tax bracket. In year 2, their combined income increases to $91,800, leaving them with $61,300 to convert.

Should the Smiths consistently apply this approach, they will have completed their TSP conversion by age 57. However, after year 19, the Smiths’ income will have grown to the point where they can no longer convert at the 25% bracket. As a result, they will still have a little over $111K remaining in their TSP account. By age 70, their $111,000 this will have grown to over $167,000.

The Smiths would pay $171,144.77 in taxes for their Roth conversions. This is more than the total amount converted in Scenario 1. However, it also includes the conversion of income growth within TSP account. As a result, the Smiths will have a total of $684,579 over the course of 19 years. This represents an effective tax rate of 25% on the entire conversion.

Accounting for inflation, the Smiths will have paid a net present value (NPV) of $137,658.60. In other words, using the inflation figure in the scenario, $137,658.60 represents the current value of the $171,144.77 tax liability paid over 19 years. Conversely, the $167,533.30 in Scenario was paid in Year 1, so there is no inflation impact.

If allowed to grow over time, the Smiths will have accumulated a little over $1.7 million in their Roth account. When combined with their TSP account, their combined retirement accounts come to a little over $1.95 million.

While this represents the most accumulated wealth of any scenario, the Smiths will have to deal with RMDs under this scenario (see summary table below).

Scenario 3: Roth conversion at no higher than the 28% rate.

This scenario resembles Scenario 2, except the Smiths now convert at the 25% and 28% marginal rates. Since they’re able to convert more of their income each year, they’re able to finish their conversions by Year 4.

Scenario 4: Roth conversion at no higher than the 33% rate.

This scenario resembles Scenario 3, except the Smiths now convert at the 25%, 28%, and 33% marginal rates. Since they’re able to convert more of their income each year, they’re able to finish their conversions by Year 2.

Scenario 5: Roth conversion at no higher than the 35% rate.

This scenario resembles Scenario 3, except the Smiths now convert at the 25%, 28%, 33%, and 35% marginal rates. Since they’re able to convert more of their income each year, they’re able to finish their conversions by Year 2. This essentially is no faster than Scenario 4, but a little more expensive, since there is income that’s converted at 35% instead of at 33%.

Side-By-Side Comparison & Observations

Below is a breakdown of the numbers from each scenario.

| Maximum Conversion Rate | Total Tax Liability | Inflation Adjusted Tax Liability | Average Tax Rate | Roth Account at Age 70 | TSP Account at Age 70 | Total Accounts | Years |

|---|---|---|---|---|---|---|---|

| 25.00% | $171,144.77 | $137,658.60 | 25.00% | $1,785,068.10 | $167,019.16 | $1,952,087.26 | 19 |

| 28.00% | $146,937.90 | $139,350.10 | 26.71% | $1,858,855.61 | - | $1,858,855.61 | 4 |

| 33.00% | $152,006.87 | $147,265.82 | 29.52% | $1,787,201.54 | - | $1,787,201.54 | 2 |

| 35.00% | $151,839.47 | $151,839.47 | 29.71% | $1,781,723.38 | - | $1,781,723.38 | 2 |

| 40.00% | $167,533.30 | $167,533.30 | 33.51% | $1,686,393.10 | - | $1,686,393.10 | 1 |

Observation 1: All scenarios allowed for Roth conversions before RMDs were to begin. The only limitation was in the 25% scenario, because the Smiths’ income eventually exceeds the 25% tax bracket. Realistically, this probably would have stretched out a few years longer because the IRS normally adjust tax brackets for inflation. It’s feasible that when tax bracket adjustments are taken into account, the Smiths could have completely converted before age 70 ½.

In a real-world scenario, it might be worthwhile to evaluate Roth conversions in the context of retirement planning. Odds are the Smiths could have been in a position to retire in their 60s. If that’s the case, they could have done much of their conversions in the 15% tax bracket. Retirement years can be a great opportunity to take advantage of low tax brackets for Roth conversions…just ask Doug Nordman. He’s been retired since his early forties.

Observation 2: The Smiths actually paid more in taxes under the 25% scenario than any other scenario. However, when you account for the tax-deferred growth INSIDE the TSP account, you’re paying taxes on those earnings as well. In the 25% scenario, the Smiths convert $684,000 from their TSP account, which is over a third more than the original amount.

In real life, the total amount that is converted would depend on the investment performance on the pre-conversion assets over time.

Observation 3: When adjusted for inflation, the tax liability for the 25% scenario was actually less than any other scenario. When accounting for the time-value of money, the net present value of Year 18’s tax bill ($2,012.50), actually ended up being roughly half: $1,072.79. Even though more taxes are paid over a longer period of time, the value of future taxes goes down in today’s dollars.

The higher the inflation rate, the more important it is to account for inflation in your projections.

Observation 4: There is a direct correlation between converting at the lower tax bracket & having the most overall wealth. Although there was less money in the Smiths’ Roth IRA under the 25% scenario than under the 28% scenario or the 33% scenario, that’s because the Smiths were unable to convert the full TSP amount. In a scenario where the Smiths are able to convert 100% of their TSP into a Roth account (see figure below), converting at the 25% ensures the highest Roth account balance at age 70.

Observation 5: The more room you have within your tax bracket, the faster you’ll be able to make Roth conversions. This sounds intuitive, but the more that you’re able to convert within your desired tax bracket, the less you’ll have to convert next year. Not only will you convert less of your principal, but you’ll convert less of the earnings upon that principal.

Below is a projection using the same figures except that the Smiths start at a lower salary (conveniently at $35,900, which puts them at the 25% tax bracket). This scenario would have allowed them to convert faster at the 25% bracket than in the original case study, since they had more room within their bracket to do so each year.

| Maximum Conversion Rate | Total Tax Liability | Inflation Adjusted Tax Liability | Average Tax Rate | Roth Account at Age 70 | TSP Account at Age 70 | Total Accounts | Years |

|---|---|---|---|---|---|---|---|

| 25.00% | $161,744.95 | $139,877.33 | 25.00% | $1,902,137.61 | - | $1,902,137.61 | 10 |

| 28.00% | $143,434.96 | $136,956.57 | 26.37% | $1,866,855.00 | - | $1,866,855.00 | 4 |

| 33.00% | $149,402.60 | $145,098.82 | 29.07% | $1,798,377.44 | - | $1,798,377.44 | 2 |

| 35.00% | $149,235.20 | $149,235.20 | 29.25% | $1,792,899.28 | - | $1,792,899.28 | 2 |

| 39.60% | $165,474.70 | $165,474.70 | 33.09% | $1,696,835.08 | - | $1,696,835.08 | 1 |

Conclusion

While there are many factors that go into Roth conversions, it’s important to recognize the impact that your marginal tax rate can play in the timing of those conversions. In each of these hypothetical situations, the Smiths had plenty of time in order to implement their Roth conversion strategy.

I hope this article helped conceptualize the concept of spreading Roth conversions over a multi-year period. However, it should not be considered a substitute for a financial plan that accounts for all the variables in your life. If you have questions, you should talk with a fee-only financial planner or tax professional in your area.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.