When service members risk their lives safeguarding our country, it is our country’s job to safeguard them. Unfortunately, the military community often finds itself targets of predatory financial entities.

In 2006, the government stepped in to safeguard the finances of military members and their families. In the sea of resources for the military community, the Military Lending Act (MLA) is a legal protection that exists whether you are aware of it or not. The most prominent feature of the Military lending Act is a 36% interest-rate cap on most consumer loans.

The Military Lending Act Protects the Military Community

The Military Lending Act Protects the Military Community

How often do you read the fine print of contracts? What is the interest-rate cap for consumer loans for military members and their dependents?

Don’t feel bad if you aren’t confident with your answers to the questions above. That is exactly where the MLA comes in.

The Consumer Finance Protection Bureau (CPFB), an organization entirely dedicated to creating bright lines of clarity in lending, offers a host of information on fair practices and resources for consumers on lending in a general capacity. It is vital for all citizens to learn what allowances and limits are normal versus excessive. This resource is your starting line.

What is the Military Lending Act?

Essentially, the MLA ensures that service members and their dependents don’t fall victim to outrageous interest rates, charges or provisions associated with lending.

A 36% annual interest cap military annual percentage rate (MAPR) is applied to the following:

- Finance charges

- Credit insurance fees or premiums

- Participation, cancellation, application or other fees

- Add-on related products sold along with the credit within an agreed-upon contract

- Student loans

- Credit cards (as of 2017)

Credit-related situations are rarely pleasant, especially for non-local military members or their families who rely on the integrity of a business to provide a fair deal. The MLA was created to both educate the military community and ensure predatory lending practices become a thing of the past.

Who is Eligible for MLA?

Your local JAG office is the best place to go for advice, as well as to determine whether your personal situation falls under the ark of coverage. Active duty is generally the key phrase to look for when determining coverage.

The following members are eligible for protections under the MLA:

- Active-duty members

- Active-duty Reserve, National Guard troops on Title 10 orders and AGR troops

- Dependents:

- Spouses

- Children under age 21

- Children up to age 23 if enrolled full-time in an institute of higher education or is incapable of self-support because of a mental or physical incapacity that occurs while a dependent of a service member

- Dependents earning over half-time support or those earning over half-time support with any mental or physical disability

- Same-sex couples of eligible members

In order to qualify on active duty, you must have been in an active-duty status for over 30 days.

While it may seem complicated, the MLA was designed to protect military consumers in an effort to keep the force financially ready. A strong home front has always been the key to mission readiness and success for military members worldwide.

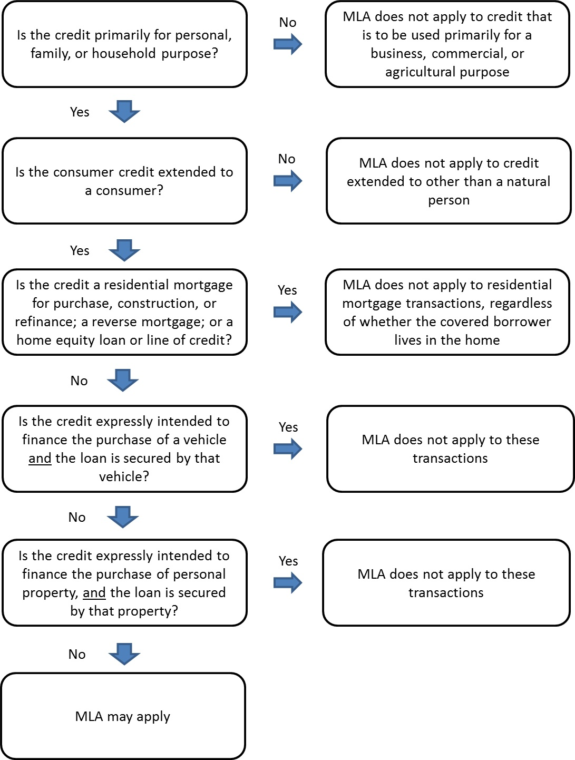

The National Credit Union Administration (NCUA) created a helpful flowchart (source) to aid military members in determining if their situation may be covered under the act. In all instances, consumer awareness remains the underlying and critical component of all financial transactions. Know your rights and benefits, and maintain an accurate and detailed record of all transactions.

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

When Does the MLA Apply?

Unfortunately, the list of what is not covered is longer than what is. Lending situations expressly covered under the MLA include:

- Payday loans – Short-term loans, generally less than $500, which are due upon the borrower’s next paycheck

- Deposit advance lending – Similar to payday loans, but made by financial institutions; the borrowed amount is automatically withdrawn from the borrower’s next paycheck

- Vehicle title loans – Short-term loan using the borrower’s vehicle as collateral

- Overdraft lines of credit – Lines of credit at a banking institution to prevent overdrawing the member’s checking account

- Installment loans – Unsecured loans that are repaid over time with fixed payments; generally personal loans

The bulk of these scenarios are preventative coverage loans that use collateral, like a vehicle’s title or regularly occurring paychecks, to cover the loan at a higher interest rate. Remember to carefully research companies that offer these types of loans.

What Isn’t Covered

Eligibility under the MLA guidelines is perhaps one of the most important fine print outlines consumers need to read in full.

The MLA does not cover loans that relate to the procurement of property, such as a home or car. Examples include:

- Home mortgage loans

- Building loans for a home

- Home equity lines of credit or credit loans

- Personal property loans

- Auto loans

Additional Benefits Under the Military Lending Act

Though not expressly a benefit from the MLA, many credit card companies interpret the MLA in such a way as to waive annual credit card fees for military members and their qualifying dependents.

These include major credit card issuers, such as Chase Bank and American Express, both of which waive annual credit card fees, even for some of their more popular travel cards. Some of those cards carry annual fees that would otherwise run several hundred dollars per year and provide similar value in benefits to cardholders each year. Some of the perks can include free airport lounge access, annual travel credits, excellent rewards on purchases and much more.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.