I’m sure you now your credit score is important. It can affect your ability to get a loan, buy a home, get a good interest rate on a loan, or even get a job. But what you may not know is there is no “one-size-fits-all” standard for credit scores. In fact, there are literally hundreds of different credit scores out there. Some of the credit scores are specific to a certain credit bureau, while others may be specific to the type of loan you want to apply for. For example, there is a specific credit score for mortgage applications.

The good news is that even though there are many different types of credit scores, there are a few which are more widely recognized than others, and many of them use the same criteria and records to create your credit score.

What is a credit score? Your credit score is simply a numerical representation of the amount of risk you present to a lender. The higher your credit score, the lower the perceived risk of default. Even though there isn’t “one standard” for credit scores, most of them follow similar guidelines, so while the underlying numbers may differ slightly between credit scoring agencies, the principles they use are generally similar. (note: virtually every credit score is proprietary, meaning the companies aren’t willing to publish the exact factors or algorithm they use to generate your credit score. It’s just like a top chef guarding the ingredients and measurements for his secret sauce!).

Different Types of Credit Scores

Let’s take a look at some of the different credit scores and what they use to come up with your credit score. Armed with this information, you should be able to learn enough about your personal credit profile to begin improving your credit score.

The FICO credit score. We said there isn’t one standard for credit scores, which is true. But the FICO credit score is probably the longest standing and most widely recognized. It is the credit score most likely used by lenders. That said, there can even be variations of the FICO score, including a FICO score from each of the three major credit bureaus, as well as variations on the FICO score depending on the purpose of your loan.

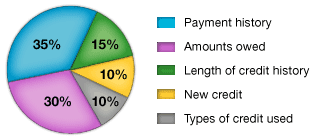

The FICO Score is comprised of information from your credit reports which is broken down as follows:

As you can see, the better you score on the more heavily weighted items, the higher your credit score will be.

More credit scores – and their ranges

But the FICO credit score isn’t the only credit score around. Each of the major credit bureaus (Experian, Equifax, and TransUnion ) has it’s own credit score which is determined from the information held within your credit report. Here are some different credit scores and their credit score ranges:

- FICO: 300 – 850

- Experian: 330 – 830

- Equifax: 300 – 850

- TransUnion: 300 – 850

- VantageScore: 501 – 990 (often assigned a letter grade, A – F)

About Experian, Equifax, and TransUnion credit scores. The three major credit bureaus in the US actively maintain credit records for virtually everyone in the US. If you have a credit history, they probably have a record on you.

About the VantageScore. VantageScore is a new credit scoring model created by America’s three major credit reporting agencies to support a consistent and accurate approach to credit scoring. This score provides lenders with nearly identical risk assessment across all three credit reporting companies.

Why are the credit scores different?

There are several reasons your credit scores may vary. The first is the source. Each of the major credit bureaus maintains its own records on your credit profile. These records can vary from credit bureau to credit bureau. That is why it is a good idea to check your credit report from each of these credit bureaus at least once per year to ensure they have the most accurate and up to date information – otherwise, your credit score could be affected. You can check your credit report from each bureau for free once per year from AnnualCreditReport.com.

Another common reason the scores may vary is that the scoring agency may use a slightly different system to determine your score. So even if the data they have is the same as another agency, the way the information is weighted may affect your score.

How to get your credit score for free (as in, no credit card required):

There are many companies that offer free credit scores – but there is often a catch. Many of them want you to sign up for a free trial of their credit monitoring service. To do this, you will need to create an account, give them your credit card number, then remember to cancel your account within the trial window, otherwise, you will be charged for the service. Now to be clear, there is nothing wrong with these services, and they provide great value for people who are concerned with identity theft or are actively rebuilding their credit profile and want to monitor your progress. But if you only have a casual need for your credit score, then there may not be a need for the credit monitoring service – and the monthly fee that goes with it.

Here are a few companies which offer credit scores with no strings attached (though you will need to create an account; it’s the only way they can access your information).

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Kim says

Thank you so much for writing such a clear, concise answer to my Google search on the different category types of credit scores. This is the only site that I found that addressed my query perfectly and thoroughly. You’re the best!