Update: The Shared Responsibility Payment, or tax penalty for not carrying health coverage, was terminated for 2019 taxes, which would be filed in 2020. Companies still issue the IRS Form 1095 to employees who have insurance, but no one is fined any longer if they do not have insurance coverage.

The Affordable Care Act now requires everyone in the United States to have “minimum essential healthcare” throughout the year, and provide proof of their health insurance coverage when they file their taxes. Those who do not have proof of insurance are required to pay a penalty, or individual shared responsibility payment, when they file their taxes. Gaps in coverage of three months or less are exempt from the penalty, as are some people with exemptions.

Showing proof of your health care coverage is easy. You just need to get a copy of your IRS Form 1095, which you should receive from your healthcare provider. There are three versions of this form, version A, B, or C, depending on which type of health care coverage you had during the previous year.

- 1095-A: Insurance purchased on the Affordable Care Act Exchange, or the Health Insurance Marketplace

- 1095-B: Other insurers, including some retiree health care plans, small businesses, military retirees, former spouses covered by TRICARE, annuitants, veterans enrolled in VA health care and those who receive Medicare.

- 1095-C: Employer-sponsored health care coverage. This includes active-duty military and federal civilian employees.

*Note: You may have more than one Form 1095, depending on which health care plans you are/were enrolled in during the previous tax year.

Obtaining a Copy of Your Form 1095

Your health insurance provider is required to provide you with a copy of your IRS Form 1095. Military members and retirees should receive their Form 1095 from Defense Finance and Accounting Service (DFAS). A hard copy of this form should be mailed to members, unless the member chooses to receive electronic copies.

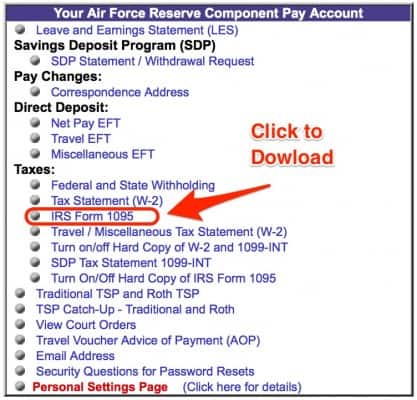

If you did not yet receive your IRS Form 1095, or you are currently away from home, you can download it from myPay. This should be available to active-duty members, retirees and members of the Guard or Reserves who use TRICARE Reserve Select.

Need healthcare coverage? Learn more about health care coverage after leaving the military.

How to Download IRS Form 1095 from myPay

Log in to your myPay account. You will see the Tax section in the Main Menu. Click the IRS Form 1095 link. You can also take other tax-related actions, including changing your tax withholding, turn on or off hard copies of certain statements, and you can download or print other tax-related forms, including your W-2 or 1099-INT from the Savings Deposit Program.

When you click the IRS Form 1095 link, you will be taken to the page with the 1095 form and additional information. You can turn hard copies of this form on or off, per your preference. You can also print the form, or get an html or text version of it.

Some members may find they have more than one version available.

Service members who retire during the year would also have two separate Form 1095s – one for their active-duty health care coverage (1095-C), and one for their retiree health care coverage (1095-B). The same thing applies for civil service members who retire during the tax year.

The important thing to do if you have more than one IRS Form 1095 is make sure your coverage extends across the entire year. This will help you avoid the “individual shared responsibility payment” (read: penalty). Of course, there are the aforementioned waivers for those who didn’t go without insurance for more than three months, and some exemptions.

How to File IRS Form 1095

Instructions for the IRS Form 1095 are included on the back of the form. Here are the basic instructions:

If you have Form 1095-B or 1095-C and you are covered for the entire year (across one or more forms), then all you need to do is check the box on your Tax Form 1040, 1040EZ, or 1040A. That’s it. You are not actually required to include your Form 1095 when you file your taxes. Reporting Tricare on your taxes will only require Forms 1095-B and 1095-C.

If you have IRS Form 1095-A, which is for insurance purchased on one of the exchanges, then you will need to enter the information from that form on IRS Form 8962. It is important to be accurate with this form, as some individuals may be eligible for a tax credit for their health care coverage, depending on whether or not a portion of their premium was paid by the federal government, their income and other factors.

Always Keep Records

Even though you are not required to file a copy of your Form 1095 with the IRS, it’s always a good idea to maintain a copy for your personal records. You should also bring a copy if you use a professional tax preparation service as your tax professional is likely to want to verify accuracy, or to maintain a copy for their records.

Finally, your 1095 will be available on myPay for 24 months following December 31 of the reporting year. If you are separating from the military, you will be able to access available statements for one year after you are separated.

When in doubt, maintain a physical copy with your tax paperwork, or scan it and save it on your hard drive, or other backup system.

In the military? Learn more about free tax preparation for military members.

Questions and Corrections: Contact myPay, DEERS or Your HR Department

If you have questions about your using myPay, you should contact the myPay Centralized Customer Support Unit at the following numbers:

- Toll free at 1-888-DFAS411 or 1-888-332-7411

- Commercial (216) 522-5096

- Defense Switching Network (DSN) 580-5096

The myPay website also lists additional sources if you have further questions about IRS Form 1095. If you have specific questions, you should use the following resources:

- Civilian employees: For health benefits questions, please contact your Human Resources Benefits Offices. For a Reissue or for general questions please contact DFAS at 1-888-332-7411.

- Military members, military retirees and annuitants: Please contact 1-888-332-7411.

If you are a military member and you need to correct the names or members that are listed on your IRS Form 1095, you will need to contact DEERS. The Form 1095 is based directly off information from the DEERS system. Here is information for enrolling a family member in DEERS.

Finally, the IRS may be another resource you can use when filing your taxes.

In the military? Learn more about free tax preparation for military members.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Marry Yingling says

Invaluable commentary . I was fascinated by the analysis , Does anyone know if my business can locate a template IRS 1095-A version to complete ?

Richard Watson, Jr says

I am a Veteran (getting my Medical coverage through the VA.) How do I get a copy of the 1095-B for my Income Taxes?

Ryan Guina says

Richard, You should receive this form directly in the mail. If not try calling the VA and asking if there is a way you can download the form.