Many military veterans are considering refinancing their VA Loan due to mortgage rates being near historic lows.

There are several benefits to refinancing your VA Loan, including a lower monthly payment, better terms, and potentially being able to pay off your VA Loan more quickly.

Your credit score is one of the most essential factors to consider when you apply to refinance your VA Loan, but it isn’t the only factor.

Let’s take a look at what lenders look at when you apply to refinance your VA Loan.

How Credit Scores Impact Refinancing a VA Loan

The first question that often comes to mind when considering a VA Loan refinance is what credit score is needed to qualify for the loan.

This is an important factor to consider, but it isn’t the only factor you need to look at.

Most mortgage lenders also consider other factors when approving a refinance application. Some of these factors include your debt to income ratio, credit history, and the amount of home equity, or ownership you have.

That said, in general, the higher your credit score, the lower your interest rate, and the easier it is to refinance your VA Loan.

Let’s take a look at how your credit score impacts your ability to refinance your mortgage, and look at the other factors lenders look at when you refinance your home.

You Need a Good Credit Score

As for the credit score required to refinance a VA Loan, there isn’t a set floor. The VA doesn’t have any hard requirements for credit scores, so it’s up to the lender you are working with.

While there is no minimum credit score required to refinance your VA mortgage, most lenders require a credit score of 620 or higher. And of course, the better your credit score, the easier it is to be approved for your refinance, and the better your interest rates will be.

Each lender has a different minimum credit score requirement for refinancing approvals.

However, you should assume that you need your credit score to be in a high credit score range.

If your credit score isn’t high, then you should work to improve your credit score before you apply for a refinance loan, which will help improve your chances of having your VA Loan refinance approved.

Debt to Income Ratio

Your debt to income (DTI) ratio represents the percentage of the monthly gross income that goes toward paying your fixed expenses such as debts, taxes, fees, and insurance premiums.

Lenders use your DTI ratio as an indicator of cash flow to see how what percentage of your income is going toward fixed costs. For example, most lenders don’t want to see your debt to income ratio exceed more than about ⅓ of your total income.

There is some wiggle room with this number, depending on individual circumstances. But how much depends on the lender. So you should do your research when applying to refinance your mortgage.

Lenders use different standards for loan and refinance approvals, but the thing to remember is a lower DTI ratio is better than a high DTI ratio.

Credit History

Your credit score is a direct reflection of your credit history. Lenders use your credit history to verify how well you have handled credit in the past.

Past performance isn’t always an indicator of future performance, but it has proved to be useful for lenders.

A few blemishes may not hurt your chances of a VA Loan refinance, especially if they happened some time ago. However, your recent credit history is weighted more heavily than older credit history. So if you have some recent credit issues, it would be a good idea to clean up your credit history for several months before applying for any new loan or trying to refinance your home.

Home Equity

The larger the percentage of your home you own, the easier it may be to get approval for a refinance loan.

Lenders typically prefer the owner to have around 20% home equity before they will approve a refinance loan, but this isn’t a hard rule with all lenders. This is also more true with refinancing conventional mortgages compared to VA Loans, which don’t require a down-payment.

There are also some government programs available for people who have less than 20% home equity.

How to Improve Your Credit Score Before Applying to Refinance Your Home

The most important thing to do is to understand how your credit score works. Once you have that down, you can take the necessary steps to improve your score. And because your recent credit history is weighted more heavily, you should ensure you have several clean months of credit history before applying for a refinancing loan.

How Your Credit Score is Calculated

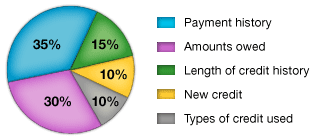

Your credit score is comprised of the following factors:

- 35% – Payment History

- 30% – Amounts Owed (credit utilization)

- 15% – Length of Credit History

- 10% – New Credit (Average age of each account)

- 10% – Types of Credit Accounts

The above percentages relate to the FICO credit score model, but other credit score models have similar breakdowns. Your credit score is just a numerical representation of your credit risk profile.

Banks are mostly concerned with getting their money back, which is why your payment history is so important. Make your minimum payments on time, every time, and you will be well on your way to having a high credit score.

But it’s not all about just making minimum payments. The amount of credit owed plays a role as well. This is why banks consider your credit utilization, or the percentage of available credit you are using.

For example, if you have a credit card with a $10,000 credit limit and you have a $2,000 balance, you are utilizing 20% of your credit availability for that specific card. Your credit score will take each available line of credit and add them together.

The length of your credit history and new lines of credit also impact your score. The average age of credit takes into account loans or lines of credit you have had for a long time. For example, a credit card you have had for 10 years counts more for your score than one you have had for 10 months.

Opening new lines of credit can also be seen as a risk, since you are opening new avenues for taking on debt. So it’s a good idea not to open a new credit account or make an installment purchase right before applying to refinance your VA home loan.

In other words, don’t buy a new car with a loan, then apply to refinance, even if you can afford both payments. You would do better to first refinance your home loan, then purchase a car (if you must do both).

Finally, the types of credit impact your credit score. Some types of credit are better than others. For example, having a home loan or anything secured, such as a car loan, is better for your credit score than unsecured loans, such as a credit card or a signature loan from the bank.

Even the type of unsecured loan can have an impact on your score. For example, store credit cards can be less desirable on your credit score than a bank credit card. And at the bottom of the list are things like title loans and payday loans, which can have a brutal impact on your credit score.

How to Get a FREE Copy of Your Credit Score

The government requires each credit agency to provide a free copy of your credit history once each year through AnnualCreditReport.com. However, your credit history is not the same as your score. There are several companies that offer credit scores. The most popular is the FICO Credit Score. But VantageScore is another popular credit score.

Many companies charge for your credit score, but you can get it for free through several websites, including Credit Karma, Credit Sesame, and through several banks and credit card companies. For example, USAA offers members a free credit score.

You can learn more about getting a free credit score here.

What if Your VA Loan Refinance Application is Declined?

Lenders can approve or decline a refinance application for a variety of reasons, so your best course of action is to speak with the loan officer who rejected your application and ask him or her to explain why your loan application was declined and if they have any recommendations you can use to improve your odds of being approved for a future VA Loan refinance application.

You should also be aware that a new law will soon require lenders to give you a free credit score when they decline your loan application.

This information can be help determine your next steps to improve your credit score or work on other areas, such as improving your debt to income ratio, improving your credit history, or increasing your amount of home equity.

Find current VA Loan rates on our site, or visit an authorized VA Loan provider to see what your refinancing options are.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.