There is good news for those who are eligible for the Post-9/11 GI Bill — you may be eligible to transfer your GI Bill to a spouse or child if you meet the minimum service requirements and agree to extend your military service obligation.

There are certain limitations, and all members must be eligible to serve an additional four years to transfer their GI Bill benefits to a family member.

More information on GI Bill transfer eligibility is found below.

Update: Additional changes may be coming soon to transferred GI Bill benefits. Recent legislation would cut the Monthly Housing Allowance in half if the benefit is transferred to children (those who have already made the transfer will be grandfathered into the current system with a 100% housing allowance for children). Those who are thinking about transferring this benefit should do so ASAP to avoid reduced benefits for their children. Read more about the GI Bill transfer changes.

Who Can Transfer GI Bill Benefits

The GI Bill benefits transfer policy is designed as a retention tool to entice mid-career service members to commit to additional military service. Because of this, eligibility rules target those members based on their service time and eligibility to serve an additional four-year service commitment.

Post-9/11 GI Bill Transfer Eligibility Rules:

You can only transfer GI Bill benefits if you are eligible for the Post 9-11 GI Bill and you meet one of the following criteria:

- Have at least 6 years of service on the GI Bill transfer request date, and you agree to serve 4 more years.

- Are eligible to serve an additional 4 years of military service.

Note: Each branch can implement the transfer rules based on DoD policy. Please see your Human Resources or personnel office for more information or to start transferring your benefits. Your branch will be able to help you start the transfer process, ensure you are eligible to serve an additional four years, and help you extend your service commitment.

Eligible GI Bill Benefits Recipients:

Dependents must be in the DEERS System. The following dependents are eligible:

Spouses:

- Can receive benefits immediately (starting August 1, 2009).

- Can use GI Bill benefits for up to 15 years after the service member separates from active duty.

- May still use the benefits after a divorce if the military member agrees.

- Spouses will not receive a monthly housing or book stipend while the member is on active duty.

Children:

- Can use benefits after the service member completes at least 10 years of service, provided they have earned a high school diploma or equivalent or reached age 18.

- Can use the benefits while the service member remains on active duty or after the member separates.

- Are eligible to receive a monthly housing or book stipend while the member is on active duty.

- May receive benefits after marriage.

- Cannot receive benefits after age 26.

The Purpose of the GI Bill Transfer Program

The Post-9/11 GI Bill was designed as a retention tool to keep mid-career military members in uniform. This is why there are minimum service requirements, and the GI Bill transfer program requires military members to incur a four-year service commitment.

It is important to plan around the four-year service commitment. you want to ensure you have enough retainability to be able to transfer your GI Bill. So, don’t wait until right before you are planning to retire. You may find that you aren’t able to serve an additional four years, and the transfer may be denied. Be aware of your service’s high year tenure rules, and plan accordingly.

When the Post-9/11 GI Bill was created, the military struggled to maintain its end strength. The new GI Bill was a carrot dangled in front of troops — serve a few more years, and you will be eligible for an enormously valuable benefit. The ability to transfer this benefit is unprecedented, as virtually no other veterans’ benefits are transferable to the spouse and children (except for some benefits that transfer posthumously).

Retention is not a problem now. Congress is looking for ways to cut costs, including a large reduction in force (RIF). This may impact the value of the benefit you transfer unless you have already done it or you will do it soon.

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

Members Who Are No Longer Eligible to Transfer the GI Bill

Changes to the DoD GI Bill Transfer policy have removed the ability for some service members to transfer their GI Bill to family members. These changes have been made in keeping with the intent of the GI Bill transfer policy, which is to serve as a retention tool.

No Longer Eligible – Retirement Eligible Service Members:

The original law grandfathered in certain service members near retirement if they could not serve an additional 4-year service commitment. The original bill allowed those who

- “Are retirement eligible from August 1, 2009 through August 1, 2012 to transfer their GI Bill, provided the member agreed to serve one more year of service starting from the date the GI Bill benefits are transferred.”

Why this provision was removed: This provision was included in the original law to allow all current service members to transfer their GI Bill to family members. This eligibility option has been removed because the GI Bill transfer benefit is a retention tool, and all currently serving members will have had the option to transfer their benefits leading up to their retirement eligibility. This provision is no longer necessary. Retirement-eligible members can still transfer GI Bill benefits through July 11, 2019, provided they are eligible to extend their service commitment for an additional 4 years.

No Longer Eligible – 10+ Years of Service, but Ineligible to Extend 4 More Years:

The first version of the law allowed members to transfer their GI Bill if they

- “Have at least 10 years service and cannot serve 4 more years because of policy or law, but you agree to serve as long as you are able by law or policy.”

Why this provision was removed: This provision was removed with the 2018 policy update. The new policy removed the ability for members to transfer benefits if they cannot extend 4 more years of service. This most frequently impacts those who run into High Year Tenure rules, Time in Grade, mandatory retirement laws, or inability to extend due to medical or administrative reasons. The provision was removed in keeping with the GI Bill transfer policy’s intention to serve as a retention tool.

Transfer Benefits Now: You Have Nothing to Lose

The best part about transferring benefits (besides blessing your dependents with a free education) is that the transfer is non-binding. You can transfer your benefits to your dependents today, then later decide to decrease or even rescind those benefits.

When you transfer benefits, you can transfer a minimum of one month to each eligible dependent (the dependent must be in the DEERS system to be eligible to receive transferred GI Bill benefits). You can later change your allocation of benefits at any time.

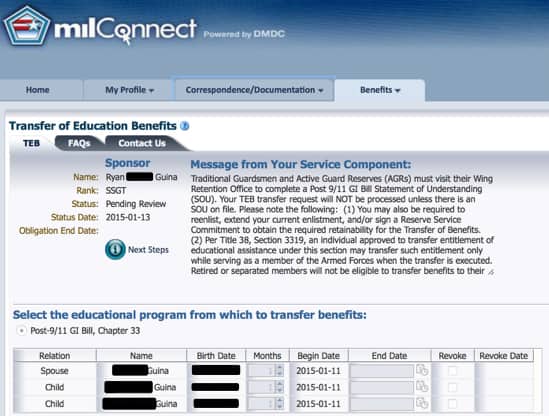

To make changes, log into your MilConnect account and update the number of months you are transferring to each individual (up to the maximum allowed). This can be found under:

- MilConnect Home –> Benefits –> Transfer of Education Benefits

Remember, there is no downside to transferring your benefits because you can always go back and change how the transferred benefits are allocated.

Other Important GI Bill Transfer Notes

This only applies to the Post-9/11 GI Bill. This does not apply to the Montgomery GI Bill program.

Transfers must be made while the member is still serving. Members cannot transfer benefits once they have retired or separated from the military.

What if You Are Unable to Complete 4 Years of Service After Transferring the GI Bill?

Members who transfer their benefits and extend 4 years, but cannot complete 4 years of service, need to seek guidance from the VA. Current olicy allows members to keep their benefits if they are separated due to medical retirement, disability, or Force Shaping.

However, there may be some instances in which the member may no longer be eligible to transfer the benefits if they cannot complete 4 years of service. It is recommended each member consult with their Human Resources, Personnel office, or the VA for more information.

How Much of the GI Bill Benefits Can I Transfer?

The military member can transfer up to 36 months of GI Bill benefits and can allocate them among eligible recipients at any time (but only once per month). The service member may also cancel a family member’s use of the benefits at any time. The benefits belong to the service member, and the intent of the GI Bill transfer program is not to change that.

Transfers Are Revocable, and Allocations Can be Changed at Any Time

Members are encouraged to transfer benefits if they are eligible to do so because they can always change their minds. The minimum transfer is one month of benefits.

For example, I am eligible for the Post-9/11 GI Bill. I have 36 months of benefits. I am married with two children. To begin with, I transferred 1 month of GI Bill benefits to each of my dependents, and still have 33 months to use for myself. I can change this allocation of benefits at any time.

To make changes, log into your MilConnect account and update the number of months you are transferring to each individual (up to the maximum allowed). This can be found under:

- MilConnect Home –> Benefits –> Transfer of Education Benefits

Remember, there is no downside to transferring your benefits because you can always go back and change how the transferred benefits are allocated.

Changes Are Limited Once You Separate or Retire

You can add and remove dependents to your GI Bill benefits transfer while you are still serving in the military. However, you can no longer add dependents to your transfer once you have retired. You can only remove benefits or change the allocation between them. Keep this in mind before you separate or retire from the military.

Transfer Benefits Now – They Could Change in the Future

In 202, legislation was proposed to cut the Military Housing Allowance by 50% for future Post-9/11 GI Bill transfers to children. This proposal would not apply to those who have already transferred benefits. This change would only affect the housing allowance, not the amount of the GI Bill benefit itself.

The monthly housing allowance is generous. It pays the same rate as the BAH for E-5 with dependents. Depending on where you live, this can range from around $700 to $3,000 per month. In some cases, the BAH rate is substantially higher than the cost of room and board through local universities. The MHA is intended to give veterans a decent standard of living while attending school. But the benefit also transfers to dependents.

This legislation did not come to pass. But it shows that benefits cuts may happen at some point. It’s best to be grandfathered into the current system if possible.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Rafaela Arnall says

I want to transfer my post 9/11 benefits to my daughter however I retire in 24 months. I was told I need a minimum of 48 months left of service to be able to transfer the benefits?

If this is the case it is ridiculous

Ryan Guina says

Rafaela, I can understand your frustration. The GI Bill transfer benefit is a retention tool designed to keep servicemembers around longer. It has a four year service commitment. Spread the word to all of your troops so they start the process as soon as possible. Best wishes!

George Kevin Anderson says

I was honorably discharged in February of 1990 from United States Navy…have never used GI Bill and wanted to know if I could transfer to my son…I do have an High School Diploma from Scarborough High School in Houston, TX in 1982.

Respectfully

George Kevin Anderson

Ryan Guina says

Hello George, the VA does not allow the Montgomery GI Bill to be transferred to family members. The military authorizes the transfer of the Post-9/11 GI Bill to family members, provided the servicemember meets eligibility requirements and agrees to serve four more years in the military. The GI Bill transfer is a retention tool designed to keep servicemembers in the military longer. As such, it is only available to current servicemembers. Best wishes!